www.integracredit.com/myintegraoffer – Loan Application guide for IntegraCredit

How to Apply for Integra Credit Installment Loan :

Integra Credit provides expensive personal loans which are available for people with credit scores in the bad credit range. Their main selling point is that they don’t do a credit check during the application. That means you will get easy approval without harming your credit score.

Benefits of Integra Credit Loan :

- There will be no credit check.

- Accept bad credit

- There are no origination fees

- No prepayment fees

- The funding in as little as one business day

How to Apply for Integra Credit Installment Loan :

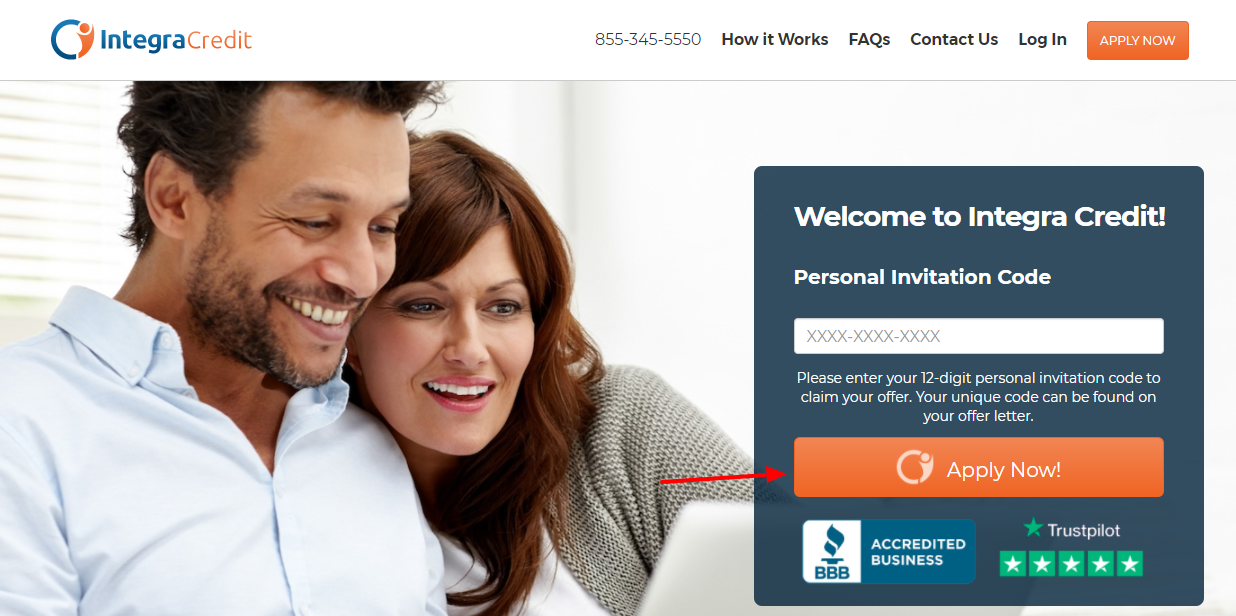

In order to apply for the Integra Credit loan, you will require your Personal Invitation Code. You will get your 12 digits invitation code on your offer letter. With your invitation code, you have to follow these simple steps below:

- You have to click on this link www.integracredit.com/myintegraoffer.

- Then, on the right side of the homepage, you have to provide the invitation code.

- After entering your invitation code, simply click on the Apply Now option.

Then, you have to follow the on-screen guideline to complete the application process.

Then, you have to follow the on-screen guideline to complete the application process.

Integra Credit Loan Rates & Fees :

Integra Credit loans are very expensive, compare to the others in the market. They come with the cheapest APR being 99% and the most expensive being 300%. The overall range can vary state-wise. While Integra Credit provides loans like personal loans, but their APRs are closer to payday loans. Most of the personal loans in the market have maximum APRs of less than 36%. In another word, they won’t change over time.

The only major fee that Integra charges are the late payment fees. But, the late payment fees can also vary statewide. For example, if Alabama resents paying $18 or 5% of the payment amount, California residents will be charged $10. Most of the states have a 10 to 15 days grace period before the late payment fees get charged.

You will be charged an origination fee or a penalty fee on the Integra Credit loan. Even without these fees, their loans are still plenty expensive.

Integra Credit provides small loans starting from $500 to $3,000. You will get 6 to 18 months to pay them off.

How to Access the Integra Credit Account :

If you have an Integra Credit loan account, then you can easily manage your account online. You must have your username and password to access the Integra Credit loan account. You have to follow these simple steps below to access the Integra Credit loan account:

- You have to visit this link www.integracredit.com/sign_in.

- Then, on the required fields, provide your email address and password.

- After entering all the required details, simply click on the Log In button.

- If your provided details are correct, then you will be logged in to your loan account.

Also Read : How to Access Simone Debit Card Online

Pros and Cons of Integra Credit Loan :

Pros:

- No credit checks

- Accepts bad credit

- No origination fees

- No prepayment fees

Cons:

- Very high APRs 99% to 300%

- Small loan amounts $500 to $3,000

- Late Payment Fee

- No joint applications

Integra Credit Contact Info :

If you have any questions about the Integra Credit loan, then you can contact the customer service department:

Phone Number: 855-345-5550

Fax Number: 312-229-8877

Hours of Operation: Mon to Fri 8:00 am to 8:00 pm CT

Email: support@integracredit.com

Mailing Address:

Integra Credit

120 S LaSalle St

Suite 1600

Chicago, IL 60603

Reference Link :

www.integracredit.com/myintegraoffer

Then, you have to follow the on-screen guideline to complete the application process.

Then, you have to follow the on-screen guideline to complete the application process.