www.capitalone.com – How to Activate your Capital One Credit Card Online

How To Proceed With Capital One Activate:

Capital One Credit cardholders rejoice! Now you can easily activate your Credit Card conveniently all by yourself. Log in to Online Banking and activate. Also, those who do not have an Online Banking account can activate it conveniently online or via the Capital One Mobile App(Android and iOS). For that, please check the details of the article.

About Capital One:

Capital One, colloquially known as Capital One Financial Corporation is a prominent Bank holding company with its headquarter in McLean, Virginia, the U.S.A. the bank specializes in the services personal, commercial saving, and checking account, credit cards, debit cards, auto loans, and other banking services. Capital One is regarded as one of the largest banks in the United States. The bank has 2000 ATM networks and 755 branches. Currently, Capital One deals with three crucial pillars of banking, Consumer Banking, Commercial Banking, and Credit Card.

Capital One Credit Cards Features And Rates:

Currently Capital One issues 19 different Credit Cards. Each one is endowed with unique features ad benefits making it as customizable as per the consumer demand. Take a look at some of the popular credit cards issued by Capital One:

Venture Rewards:

- On every purchase, every day, earn unlimited 2 X miles per dollar spent.

- On spending $3,000 on the purchase within the first three months, earn 50,000 bonus miles.

- Annual Fees $95.

- The Purchase Rate is 17.24% – 24.49% APR.

- The Transfer Rate is 17.24% – 24.49%.

- Zero Fees for Transferring.

Quicksilver Rewards:

- Every day, earn 1.5 % Cashback on every purchase fixed.

- On spending a total of $500 within 3 months of account opening, you will be rewarded with a $150 cash bonus.

- $0 Annual Fee.

- 0% Introductory APR for the first fifteen months. After that, it will be 15.49% – 25.49% variable APR.

- $0 Transfer Fee.

SavorOne Rewards:

- Unlimited Cashback of 3% on entertainment and dining.

- Get 2% cashback from the grocery stores.

- Get 1% cashback from other purchases.

- $0 Annual Fee.

- 0% Introductory APR for the first fifteen months. After that, it will be 15.49% – 25.49% variable APR.

- $0 Transfer Fee.

Secured MasterCard:

- On depositing $49, $99, or $200, you will get an initial credit line of $200. The deposit is refundable.

- Within six months, you will be considered for a higher credit line automatically.

- $0 Transfer Fee.

- APR of 26.99%(variable)

Capital One® Walmart Rewards™ Mastercard®:

- On purchases made from Walmart.com and Walmart app, earn 5% cashback.

- 2% Cash Back on the transaction from the travel and restaurant.

- 17.99% – 26.99% Purchase Rate APR.

- For the first 12 months, gets up to 5% Cash Back from the Walmart store using Walmart Pay.

- 20.99% variable APR Purchase Rate.

Capital One Activate By Creating Online Account:

- Open your browser and visit www.capitalone.com/support-center/credit-cards/activate

- Click on Activate New Card Online tab.

- Click on Enroll and Activate.

- To set up Online Banking account and activate the credit card, please enter the given information:

- Last Name.

- Social Security Number/ Individual Taxpayer Identification Number.

- Date of Birth(mm-dd-yyyy)

- Click on the Find Me tab.

Also Read : Activate Your Capital One Walmart card Online

Activation Procedure:

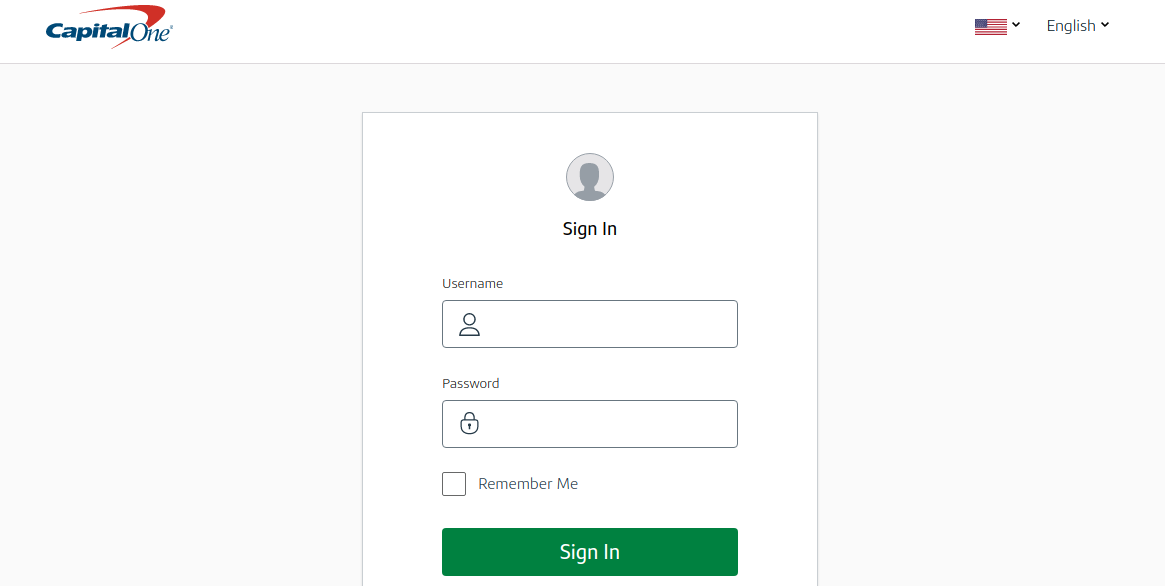

If you already have the Online Account access and wish to activate the Capital One Credit Card, check these steps:

- Open your browser and visit www.capitalone.com/support-center/credit-cards/activate

- Select Sign In.

- Type in the Username.

- Enter the Password.

- You may tap on Remember Me if you wish the browser to remember your credentials for your next login. Strictly omit this step if you are accessing from a Public Computer.

- Click on the Sign In tab.

- Enter 3 digits security code.

- Successfully complete the activation.

Recover Account Credentials:

Forgotten your account credentials? Unable to log in to your Online Access account? Give this a try!

- Open your browser and visit www.capitalone.com/support-center/credit-cards/activate

- Click on Forgot Username or Password link.

- Keep on entering the following information of the primary cardholder as part of verification:

- Last Name.

- Social Security Number.

- Date of Birth.

- Click on the Find Me tab.

Capital One Activate Via Mobile App:

- Log on to Capital One mobile app.

- Access your Online Banking account by using registered Username and Password.

- Click on your Online Banking profile.

- Select Account Settings.

- Tap on Activate Credit Card.

- Type in the 3 digits Security Code immediately as prompted.

- Your card will be activated instantly. You are now free to start using the card for online and offline transactions.

Customer Support:

Phone

1-800-CAPITAL (1-800-227-4825) (Customer Service)

1-866-750-0873 (Online Banking Support)

1-804-934-2001 (International call)

References:

www.capitalone.com/support-center/credit-cards/activate