mycornerstoneloan.org – Access to your Cornerstone Loans Account

Login to Cornerstone Loans Account:

Foundation Education Loan Services is a not-revenue driven Department of Education servicer. They have a long-term custom of excellent client care in educational loans and are glad to proceed with that custom by offering support to educational loan borrowers all through the country. They secure your classified data and are straightforward with public data.

About Cornerstone:

- They manage families through the financing of advanced education.

- They instruct understudies to put something aside for schooling, seek after grants and gives, and get carefully.

- They give upright, individual assistance to borrowers and advance capable reimbursement.

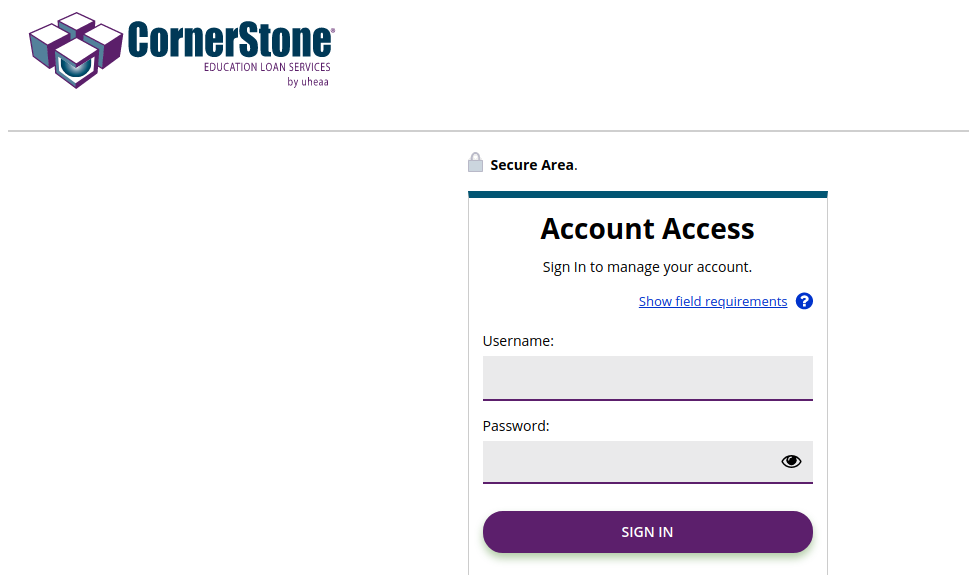

Cornerstone Loans Login:

- For the login open the page mycornerstoneloan.org

- After the page appears at top right click on the ‘My account’ button.

- In the next screen provide the login details hit on ‘Sign in’ button.

How to Recover Cornerstone Loans Login Initials:

- To recover the login information open the page mycornerstoneloan.org

- As the page opens in the login homepage hit on the ‘Having trouble’ button.

- In the next screen choose your help option and follow the prompts.

Also Read : How to Access Warner Brothers Online Account

Create Cornerstone Account:

- To create the account open the webpage mycornerstoneloan.org

- Once the page appears in the login homepage hit on ‘Create an account’ button.

- You have to provide the required information hit on ‘Continue’ button.

Tips to Get a Cheaper Mortgage:

- Get A Rate Quote: When you do look around, don’t depend on destinations that let out standard statements. Interface with a nearby loan specialist who can give an individualized rate quote all things being equal. This statement ought to incorporate numbers that mirror your own financing needs and a moneylender’s particular advance expenses so you know precisely the thing you’re getting into.

- Improve Your Financial Assessment: myFICO has a convenient little device that can reveal to you how much your FICO rating could acquire you in a home loan rate. These numbers are set at the public normal, with a lot of factors that can change dependent on the spot, individual accounting records, advance sort, up front installment, and then some.

- Increment Your Upfront Installment: There’s not, at this point a rigid standard that says you need to put 20% down. The 2020 Down payment Expectations and Hurdles to Homeownership report from the National Association of REALTORS affirmed the middle up front installment sum for all purchasers to be 12%. This dropped to only 6% for first-time purchasers.

- Diminishing Your DTI: Your DTI, or Debt-to-Income Ratio, is how much month-to-month pay you pay toward obligation, determined as a rate. This number likewise incorporates your assessed month-to-month contract installment for the future. A positive DTI sits under 36%, however, Fannie Mae and Freddie Mac have expanded their outstanding debt compared as far as possible from 45 to 50 percent to make getting simpler.

- Utilize A Rate Lock: Consider locking your home loan rate for as long as 270 days in case you’re purchasing another form or moving starting with one home then onto the next. In the event that the Federal Reserve raises its benchmark rate from close to zero this year, as certain financial experts have anticipated, this will affect contract rates in a roundabout way.

- Try Not to Stand by: The present generally low home loan rates are as yet extraordinary information for purchasers. They’re sitting at around 2.73 percent, a long way from the pinnacles of more than 18% found in the 1980s.Just per year prior, just before the pandemic, rates were at 3.72 percent. The MBA predicts that rates may arrive at a normal of 3.3 percent this year and 3.6 percent in 2022.

Cornerstone Customer Information:

If you are looking for more information call on the toll-free number (800) 663-1662. Fax: (801) 366-8400. Service members: (844) 255-8326. Send an email to customerservice@mycornerstoneloan.org. Or write to P.O. Box 145122 Salt Lake City, UT 84114-5122. Payment Address: PO Box 979133 St. Louis, MO 63197-9000.

Reference Link: