www.td.com/ca/en/personal-banking – How To Proceed With TD Canada Trust Credit Card Activation

TD Credit Cards are designed to suit the financial requirements of the customers with a myriad of preferences and credit. With a host of benefits and offers, TD Credit Cards are the ultimate companion for your wallet. Credit Cards by TD Bank can be easily activated online only after enrolling with its exclusive Online Banking portal, EasyWeb.

About TD Canada Trust

TD Canada Trust, simply known as TD is a commercial banking organization and part of Toronto-Dominion Bank (TD) in Canada. TD Canada is currently offering a large number of financial services and products. Right now, 10 million active users have opted for TD as their financial partner.

Through 1,100 branches and 2,600 ATMs all over the country, TD is constantly providing unparalleled services. The bank provides services with the help of a strong network of private bankers, portfolio managers, financial planners, mobile mortgage specialists, and investment advisors.

Advantage of TD Canada Trust Credit Card Activation- Features To Look For

TD Canada Credit Cards are part of the safe and secured digital banking network. Explore a range of Credit Cards within your grasp. Prominent specializations among them are Aeroplane Miles, Cashback, Zero Annual Fees, TD Travel Rewards, Low Rate, and more. Here are some of the prominent and popular credit cards by TD Bank:

TD Cash Back Visa Infinite* Card

- Get 10% Cashback from every purchase made within the first three months of the activation on spending the total amount of $2,000.

- Zero Annual Fees.

- 3% Cashback on eligible gas and grocery purchases.

- 1% Cashback on other purchases after three months.

- Flexibility in redeeming the Cashback.

- Travel Medical Insurance.

- Emergency Road Services.

- Cashback Dollars never expire.

- Complimentary Visa Infinite Concierge Services.

Rate and Fees

- Zero Annual Fees for the first year, after that it’s $120 per year.

- Cash Advance APR is 99%.

- Additional Cardholder Fees $50.

- 99% Purchase Rate.

TD® Aeroplan® Visa Infinite* Card

- On making your first ever purchase, earn 15,000 Bonus Miles.

- Special benefits from Air Canada while traveling on the flight.

- With every purchase made, earn Aeroplan Miles. Redeem them on flight tickets to travel to your dream destination.

- Extended Travel Insurance.

- On every $1 spent on eligible grocery products and items, earn 5 miles.

- Earn 1 mile for every on every $1.

- As long as your credit card is active, your Aeroplan Miles never expires.

- On shopping from participating locations, earn 2X Miles.

Rate and Fees

- Zero Annual Fees for the first year, after that it’s $120 per year.

- Cash Advance APR is 99%.

- Additional Cardholder Fees $50.

- 99% Purchase Rate.

TD Cash Back Visa* Card

- Earn $25 as Cashback Dollar.

- 1% Cashback on eligible grocery and gas purchases.

- 5% Cashback on any other purchases.

- Cashback Dollars never expire.

- Extended Warranty and Purchase Security Protection.

- Flexibility in Cashback redemption.

Rates and Fees

- Zero Annual Fees for both primary and additional cardholders.

- 99% Purchase Rate.

- Cash Advance APR is 99%.

Eligibility Criteria

As discussed earlier, you need to first register your card with the EasyWeb. After that, you are required to log in and perform the activation. To register for EasyWeb, you must fulfill the following criteria:

- Must be 18 years or older.

- Must be a permanent resident of Canada.

- Must have the TD Bank Credit Card with them.

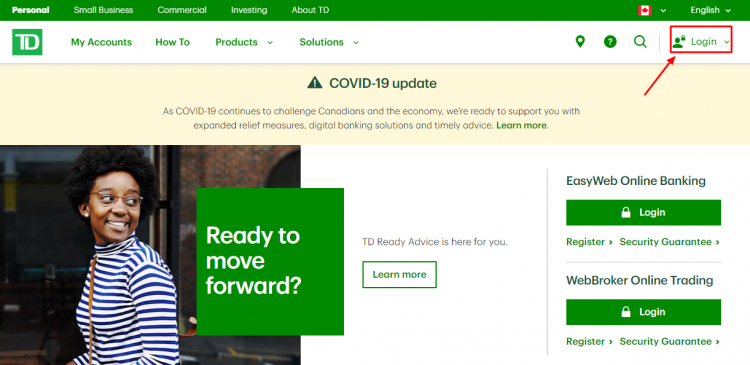

Step 1: EasyWay Enrolment To Activate TD Credit Card

This how-to proceed with the enrolment and activation:

- Open your browser and visit www.td.com/ca/en/personal-banking/

- Select Login from the extreme top-right menu.

- Under Login, select

- Tap on Register online now

- Select I would like to set up a new EasyWeb Login ID and Password option.

- Tap on Continue.

- Select Credit Card from the product dropdown list.

- Type in the Credit Card Number without any space.

- Enter the First Name of the primary cardholder.

- Enter Last Name.

- Mention primary cardholder’s Date of Birth(mm-dd-yyyy)

- Type in the Billing Address’s Postal Code.

- Click on the Continue

- Set up the account credentials. i.e. Username and Password.

- Create Security Questions and Answers.

- Complete the Account Set Up.

Step 2: TD Canada Trust Credit Card Activation And Access

Immediately after setting up the account, you can access EasyWeb and complete the rest of the activation process:

- Open your browser and visit www.td.com/ca/en/personal-banking/

- Select Login from the extreme top-right menu.

- Under Login, select

- Type in the account Username.

- Enter the Password.

- Tap on Remember Me to auto-fill the details on your next login. Please skip the step you are accessing from the public computer.

- Tap on Login.

- Navigate through your account to reconfirm the credit details.

- Follow the prompts to complete the activation successfully.

Reset Password of EasyWeb

To reset the forgotten password of EasyWeb, please go through the following steps:

- Open your browser and visit www.td.com/ca/en/personal-banking/ > Login >EasyWeb.

- Select Forgot your username or password under the Login

- Click on I forgot my password

- Type in the Username of your account number.

- Click on Submit.

- A verification process will be commenced.

- Post verification, a temporary password will be sent to the registered email address.

- Return to the login page and access using the username and received a temporary password.

- Immediately, you will be prompted to reset the new Password.

Retrieve Username of EasyWeb

Here is how to get back your EasyWeb account’s username:

- Open your browser and visit www.td.com/ca/en/personal-banking/ > Login >EasyWeb.

- Tap on Forgot your username or password under the Login

- Select I forgot my username

- Type in the Registered Email Address.

- Enter the EasyWeb Password.

- Tap on Submit.

Note

In case you forget both username and password, feel free to give a call at 1-866-222-3456. Make sure you have TD Credit Card nearby.

Read Also….. Activate Your Rogers Bank Card

Customer Support

Phone Numbers (Language-wise)

- 1-800-983-8472 English

- 1-800-983-8472 French (Choose option 2)

- 1-800-818-1400 Punjabi

- 416-307-7722 Collect

- 1-866-704-3194 TTY (Text Telephone)

- 1-877-233-5558 Cantonese

- 1-877-233-5844 Mandarin

References

www.td.com/ca/en/personal-banking/