merrickbank.com/activate – How to Activate Merrick Bank Credit Card Online

Activating Merrick Bank Credit Cards for Building Credit Scores:

Merrick bank is based in Utah, with its headquarters in South Jordan, which was founded in the year 1997. It is an online-only bank that is a subsidiary of the New York-based financial services firm CardWorks. It is a bank that offers credit cards and loans and certificates of deposits and not for the ones who want to have checking, savings, or money market accounts. This is a kind of bank that helps people build their credit scores. If you are looking for such benefits, then the content of this article is ideal for you.

Benefits of Merrick Bank:

- They will give you CDs in terms ranging from six months to two years with an APY of 0.40% to 0.71%.

- You will get an APR of 17.45% on a secured visa credit card which is Merrick Bank’s most popular product.

- They give personal loans for boat, RVs, and horse trailer, which makes an amazing offer for the people who wants to borrow a loan but is unable to because of credit history or the specificity of their purchase.

- The best thing about them is that they give their focus on the people who are having a low credit score or no credit score, though everyone does not get the acceptance.

Let us see the other factors:

- The CDs that we talked about in the benefits come with a cost, where you need to open one with a minimum deposit of $25,000, which is often out of reach for many average customers.

- The removal of the setup and maintenance fees of the credit card might be confusing sometimes.

- They do not provide any rate for loans on their website, thus making confusion among the borrowers totally with the other lenders.

- They will not offer any saving account or checking account or a money market account, thus making it a poor choice for the ones who want to complete all their work in one place.

Which customers want to avail the assistance of the Merrick Bank:

Their assistance would be attracting customers who want to build their credit history or want to get a loan. Their offers will attract-

- The ones who have a poor credit score or no credit score and want to build one.

- The ones who have no intention of pairing their needs of a general bank with their lender or credit card issuer.

- The customers who are happy with online banking mode.

The credit cards offered by the Merrick Bank:

they offer two types of credit cards

- Platinum Visa – this card is designed in a way that would help you build your credit or establish it, and your account will be under the regular surveillance of Merrick Bank so that your credit line gets increased. It has an APR of 23.45%-28.45% and comes with an annual fee of $0-$72, and an account setup fee of $0-$75.

- Secured Visa – this card comes with a $200 minimum deposit, and you are also getting the option to upgrade the limit to $3000, only to increase your purchasing power. It comes with an annual fee of $36.

Applying for a loan or a card:

You can check whether you’re prequalified for the Platinum Visa online. If somehow you are not prequalified, you can also apply for the Secured Visa online.

The persons who want to apply for a loan need to see whether they would qualify for it and need to participate with thousands of dealers across the country. Once you have completed all the setup of your loan or credit card, you can view all your information through online mode or smartphone app.

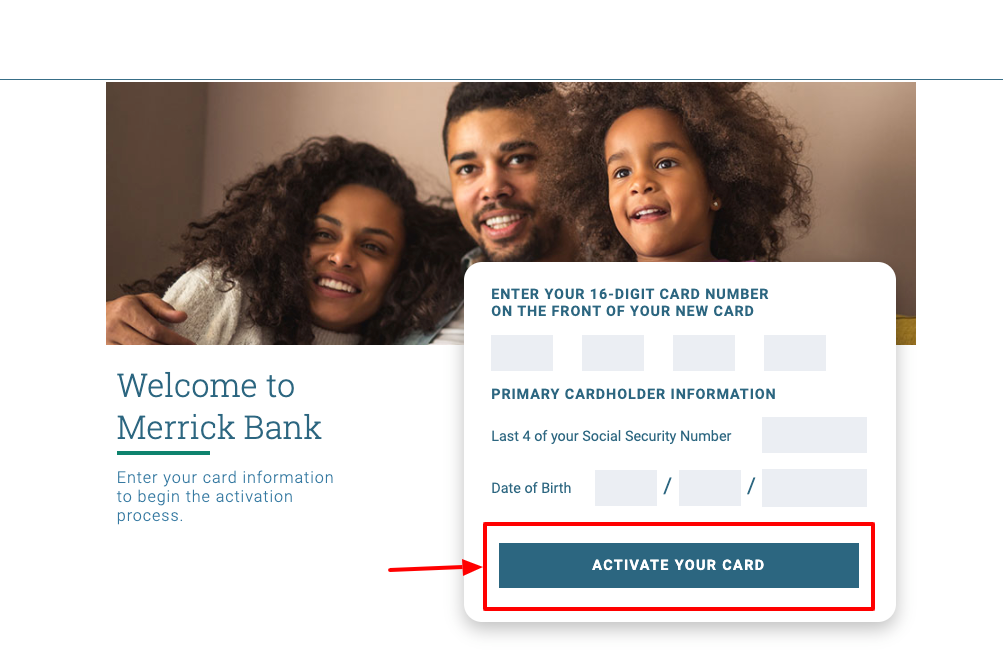

Procedure to activate Merrick Bank Credit Card:

- First is to go to the activation page of Merrick Bank from the web browser of your mobile or laptop, or you can go to the page directly using the link merrickbank.com/activate.

- On the page, you have to enter the16 digit card number, last 4 digits of social security number, and date of birth (DD/MM/YYYY).

- Then you need to click on ACTIVATE YOUR CARD.

- Follow the upcoming onscreen prompts and your card will be activated.

You can also sign up for your account to activate your card. Follow the procedure for the signup process –

- Go to the Merrick bank login page and click on the button Not Enrolled? Signup Now. You can also go to the page by directly following the link merrickbank.com/login.

- On the next page, you need to enter your account number, date of birth, last 4 digits of your social security number, and then click on Next.

- Then you need to follow the instructions to complete the signup procedure.

This will give you all the information regarding your account, credit card, loans for which you have applies, and you can keep track. You can also activate your card after the signup procedure.

Also Read: Activation Guide for SDCCU Credit Card Online

Payment for the credit card bill:

- You can pay your credit card bill by using the Online Cardholder Center at Meerickbank.com or download the mobile app for easy, secure, and quick payments.

- You can also pay the bill over the phone by making a call on the number 1-800-204-5936, and an agent or the automated system can process the payment using your savings account or debit card.

- You can also opt for the mail through money order using the address –

Merrick Bank

P.O. Box 60702

Dallas, TX 75266-0702

If you want to opt for the overnight mailings, then you have to use the following address-

Merrick Bank

Attn.: Lockbox Operations

#660702

2701 east Grauwyler Road,

BLDG 1

Irving, TX 75061

- If you are not having any options of checking, savings or debit card, then you can opt for the money services counter near you, and the charges can range from $1-$20. So it is highly recommendable to ask the cashier about the available options and fee amounts.

Some Frequently Asked Questions (FAQs):

Q. Where can be the Merrick Bank Credit Card be used?

Ans. They are Visa Cards and thus are accepted everywhere.

Q. What are their hours of operation?

Ans. The representatives of Customer Service are available 24 hours a day for seven days a week. Their number is 1-800-204-5936, TTY/TTD: 1-800-253-4563.

Q. What if I have a past credit problem?

Ans. Merrick Bank specializes in building the credit lines of the customers, so this can be a great option to build your credit score.

Q. When will my payment be considered late?

Ans. when you are not submitting your payment bills within the due date, then your payment will be considered late, and your account will be charged with a late payment fee.

Conclusions:

This article comes with all the available benefits and the activation procedure of the Merrick Bank Credit Card. During the procedure, if you face any problem, you can always make a contact with them from all the given options on the page. You can also go to the activation page, and click on the Contact Us option below or you can directly follow the link merrickbank.com/about-us/contact-us and there you will find different options on which you would like to make contact, though the mailing address for the credit card section and customer service is given below. You can also click on the Questions to clarify your doubts through FAQs. You can mail them at the address-

Merrick Bank Customer Service:

P.O. Box 9201

Old Bethpage, NY 11804-9001

You can also write to them asking the reasons why got declined for a credit card at this address

Merrick Bank

Credit Department

P.O. Box 1442

Draper, UT 84020-1442

Reference: